Benchmarking: a Case Study of an Insurance Company during the Covid-19 Pandemic

- Posted by agrAdminEGG

- On July 2, 2020

Introduction

Benchmarking is an interesting and unique method for evaluating your company performance or products. Today, we are going to show you a case study where we used benchmarking to understand what was going on during the Covid-19 pandemic in the insurance sector.

With benchmarking you can see how your business is performing in comparison to your competitors. Thanks to a specific indicator, you can keep track of your competitors. The strategies of the companies that are considered among the best in your sector will be as clear as daylight.

The first step will be that of assessing the performance of your company in the market. The purpose of this type of analysis is to calculate how far you are from the top of the ranking. This will allow you to search for models or actions that can improve your business efficiency and outperform your competitors.

In this article we will talk more in detail about benchmarking. We will focus on its importance and the different types there are out there. Ultimately, we want to show you why using it effectively is so crucial during this Covid-19 pandemic. Finally, we will see some features of AgrEGG Benchmarking, a tool of AgrEGG that is also available as stand-alone software.

The Importance of Benchmarking

Benchmarking is a very useful tool to help you get a more objective idea of your performance. In order to show you why, we will see it in action in the example below.

Let’s consider an increase in sales of one specific product; maybe our company registers a + 3%. This will be our indicator to analyze. This data alone could make us think that our current strategy is working well, therefore no improvement action is needed. However, if we look at the performance of our competitors, we might see that they register an increase of 15%. In this situation, we should ask ourselves why our company is not reaching the same sales standards as the others.

With this simple example we have highlighted how the same data takes on a completely different meaning if analyzed in different contexts.

Types of Benchmarking

Benchmarking can be divided into four types and each one has different advantages over the others:

- Internal Benchmarking: this type of analysis is carried out within the same company comparing different departments or production units. The aim is to identify those who register the highest efficiency and emulate their strategies in other departments. However, the restricted area being examined will limit you and will not allow a broad-spectrum comparison.

- External or Competitive Benchmarking: as suggested by the name, this analysis takes into consideration your competitors and focuses on overcoming internal limits. With this method you can get an idea of the performance of the companies operating in your same market. With it, you can gather information on what actions and practices have allowed these companies to reach the top levels. In this case, however, the data is much more difficult to find since it comes from competitors.

- Functional Benchmarking: with this type of analysis, you are not necessarily comparing your performance to that of rival companies, but rather to the ones that excel in a certain category of interest. The objective is to identify the best practices that led these companies to excel in that specific category. In this case, companies seem to share their data much more willingly.

- Generic Benchmarking: the best practices of a company are identified to try and import them into other sectors. With this benchmarking it would not matter if we considered two very different sectors. In this case too, companies are more likely to share data. However, it is much more difficult to implement the practices identified due to the inhomogeneities of the sectors under analysis.

COVID-19: Insurance Benchmarking Case Study

Let’s now try to understand the impact that Covid-19 is having on the insurance industry. To do that, we will take into account the performances of insurance companies in the first trimester of 2020. It might not surprise you that data shows the impact has been huge. Amongst other interesting facts, European insurers’ volume of premiums seems to have fallen by roughly 30%.

You can probably see for yourself why uncontextualized internal data could turn out to be a real threat. Almost everybody is experiencing a significant decrease, which makes it hard to understand how your strategies performed. Moreover, knowing you are among the ones who struggled, surely will not help you find your way out of it.

What you need to know is how your performance compares to that of the rest of the market. Your goal should be to understand how your company solvency has been affected in a contextualized way. With Covid-19, the goal should be to understand what is an acceptable decrease and what is a threatening drop. With benchmarking, you will have a better understanding of the situation and you will be able to act on it. Foreseeing future consequences and preventing them from becoming an issue will save your company a lot of trouble.

Focus on Solvency and Complaints

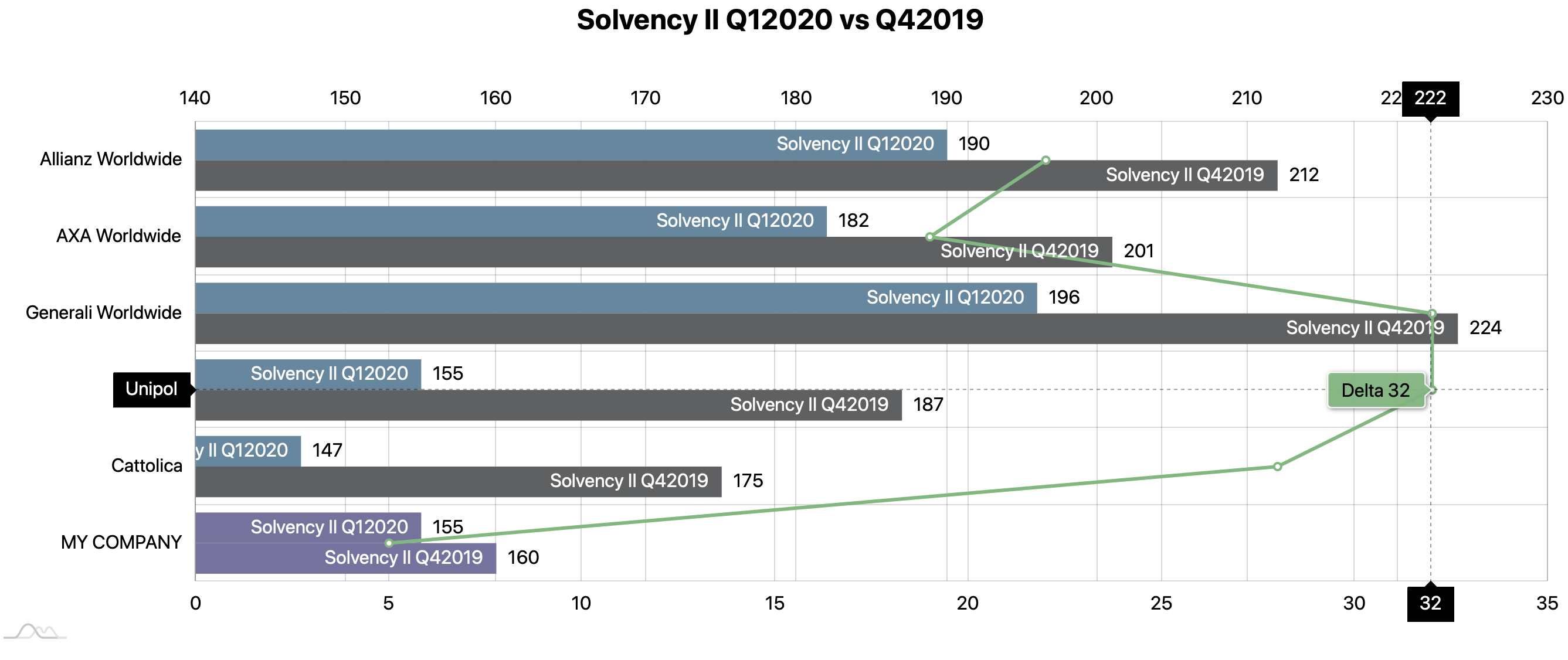

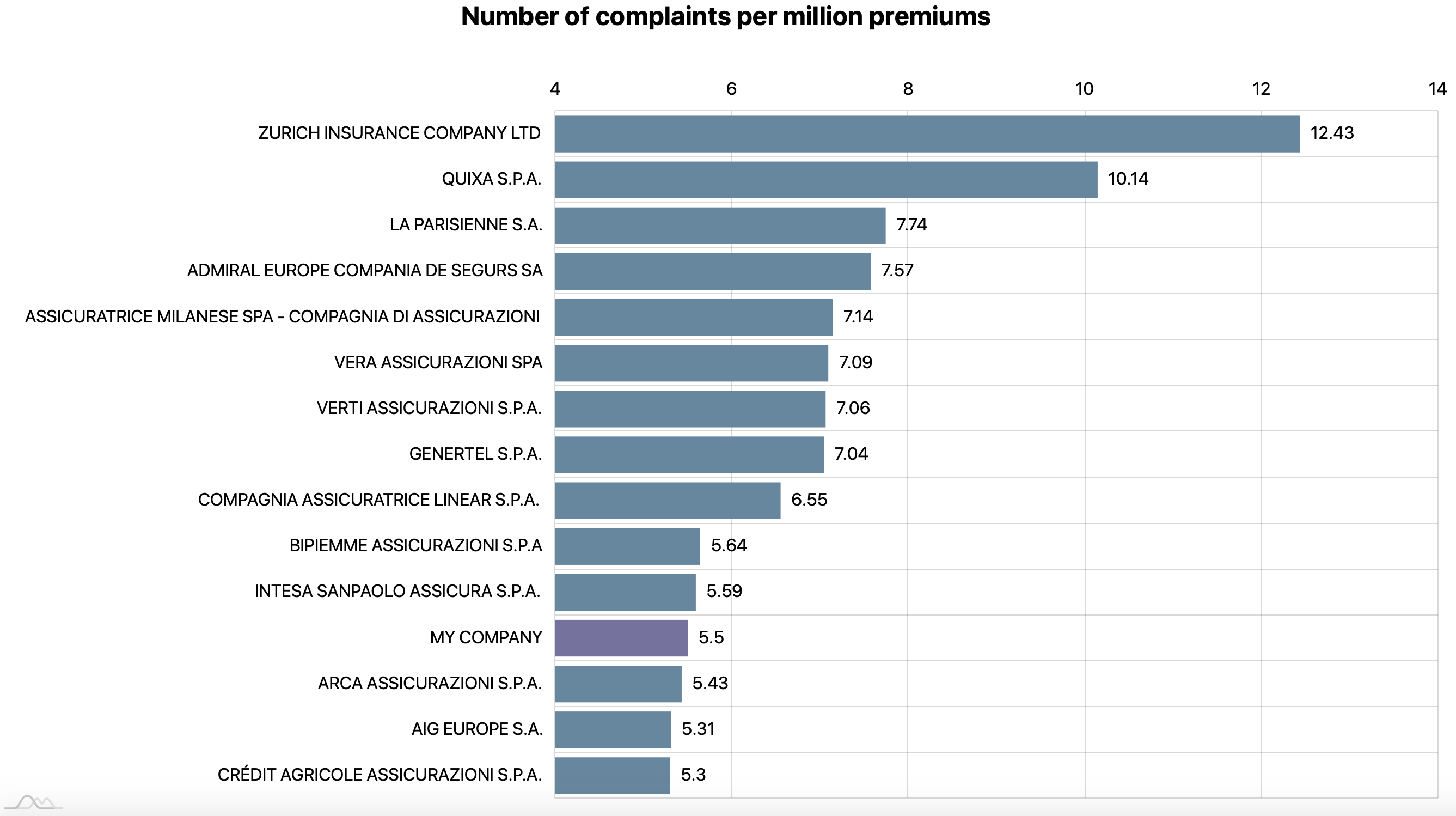

With AgrEGG Benchmarking tool, our team of experts extrapolated the solvency and complaints data of the main insurance companies. So, let’s see how a hypothetical company would position itself among its competitors.

Thanks to this graph, we can clearly evaluate the performance of our company between 2019 and 2020. However, there is more. We can also get an idea of how and with what severity Covid-19 has impacted our competitors. Amongst other things, we can also devise intervention measures to decrease the gap between us and other companies or identify actions that do not further decrease their trends.

By analyzing the graph above, we can evaluate the number of complaints. We can extrapolate, for example, information about customer satisfaction and understand which services make them more or less satisfied. In such a competitive market, being able to satisfy your customers is of fundamental importance in order to retain them.

Without comparing ourselves to our competitors, it would be difficult to evaluate our company. Internal data alone would not be enough to give us an idea of our actual performance in the market. This is when benchmarking becomes an essential ally in order to get a full picture.

Why AgrEGG Benchmarking for Insurance?

So why choosing AgrEGG Benchmarking for Insurance? In this unprecedented time it is essential to understand how the market is dealing with this crisis. Everybody else is doing it, so make sure to be prepared.

If you choose AgrEGG, our team will be extrapolating the data you need from different reliable and verified sources. All the information you need will be just one click away. With our service of data sharing you will always be on top of things so do not lose your chance and get in touch with us today.

0 comments on Benchmarking: a Case Study of an Insurance Company during the Covid-19 Pandemic